Blue Cross Blue Shield of Tennesse Vs United Healthcare

Prospective patients across the state are rattled by BlueCross BlueShield of Tennessee's bombshell decision to not sell individual plans under the Obamacare exchange in the greater Nashville, Memphis and Knoxville markets.

The company's announcement has forced many Tennesseans already bracing for premium increases to confront the likelihood that they will have to change doctors as well.

BCBST's exit from 3 Obamacare markets sends shock waves

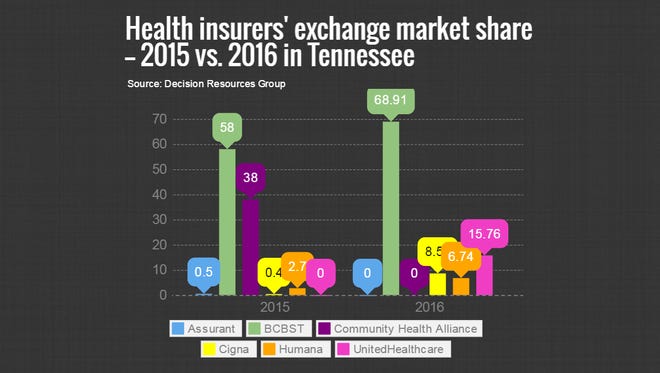

Together with UnitedHealthcare's planned departure from the exchanges next year, BCBST's exit from three of the state's eight insurance markets could leave entire health systems out of reach for people shopping for insurance in 2017.

Mark Levine, a freelance photographer in Nashville, wants to stay with his Vanderbilt University Medical Center physicians who understand and have treated his rare autoimmune disease. He, and many of his friends who also buy individual plans, were prepared for renewal letters to carry big premium increases. But he wasn't expecting to try to find ways to keep consistency in his care.

"That's certainly disconcerting — we were all anticipating a big uptick in our (premium) rates, which we were prepared to pay because we as uninsurables are very grateful we had coverage at all," said Levine.

Some health insurance shoppers look for plans based on price with little allegiance to doctors. For others like Levine, who have forged relationships with providers or who have diseases that require specialists, the decision could interrupt their care.

Chris Kane, a Knoxville resident who will be covered by a third insurer in 2017 in as many years, is concerned about whether the relationships he and his wife established with physicians in the run-up to birth of their daughter, who was born a few months ago, will be cut short.

Kane is an operations manager at Knoxville Youth Athletics and his wife works weekends, so the two will probably talk about whether his wife will have to go full-time in order to get employer-sponsored insurance He and his wife went with a pricier premium, $800 a month, to get a low deductible and low out-of-pocket costs. How they proceed is "going to be a serious family decision" once all of their options become clear.

The family is contending with some injuries from a recent car accident so the BCBST decision is frustrating, Kane said.

"(I'm) wondering how it's all going to work out and not really having a great answer," he said.

In Middle Tennessee, BCBST's exit could leave two major health systems out of the question for people who buy plans on healthcare.gov, the marketplace on which tax credits help offset monthly premiums.

In 2016, Saint Thomas Health was covered under UnitedHealthcare and BCBST. Vanderbilt University Medical Center was covered only by two BCBST networks.

If no changes are made to Cigna and Humana networks for 2017, TriStar Health will be the only Middle Tennessee system covered in plans sold on the exchange.

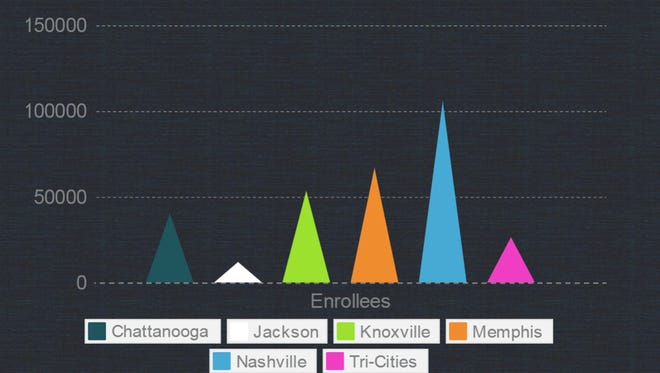

Patients and consumer advocates wonder whether TriStar — the local health system owned by HCA — will absorb a patient load previously spread across multiple hospitals. There were roughly 100,000 people in the greater Nashville area who enrolled in exchange plans for 2016; BCBST covered more than 70,000.

"TriStar Health continues to grow and expand to meet increased demand for services at our hospitals in communities across Middle Tennessee. We will continue monitoring any changing demand for services including from patients participating in the health care exchange and adjust appropriately," said Kimberly Johnson, spokeswoman for TriStar Health.

There are statewide insurance options for people who don't want to take a tax credit subsidy.

Aetna, Farm Bureau and an insurer called Freedom will be selling individual plans off-exchange statewide — meaning the shopper buys from the company or a broker but doesn't use healthcare.gov. Aetna and Freedom will only offer plans in the bronze category.

Farm Bureau, which uses a network from UnitedHealthcare, has agents in all 95 counties. While most of its insurance products, such as car insurance, require a Farm Bureau membership, nearly all of its health policies are open to everyone because of the Affordable Care Act, said Ben Sanders, executive director of government affairs for Farm Bureau Insurance - Tennessee.

For Levine and others the uncertainty is a persistent noise around whether they have access to health insurance. Levine was relieved by the outcome of the 2015 U.S. Supreme Court ruling that upheld the use of tax credits but noted the insurance market continues to be plagued by divisive political rhetoric.

As a freelance photographer he has access to insurance through a union but it's challenging to make sure he has the qualifying number of hours in a particular period.

He's uneasy from constant political clamor that could again reshape his ability to access necessary medicines and specialists.

It's a shame, he said, that concern over policy shifts constantly recalibrate how he and others access and pay for coverage.

Right now experts, including navigators and brokers, are unsure how to advise clients on 2017 coverage. Network information won't emerge from insurers until the weeks leading up to the start of open enrollment on Nov. 1.

Chuck Terry, a broker at Dunn Insurance in Clarksville, said the stream of federal rules, guidelines and pricing changes has been a "nightmare" in recent years.

But the BCBST exit and the impact it will have on families is unlike anything he's seen.

Many people on individual plans moved to the exchange to take advantage of subsidies, but now the exchange options and the benefits or networks are limited. The brokerage has a few hundred clients on BCBST plans who will have to look for something else, Terry said, noting the Cigna and Humana networks were more limited than those of BCBST.

"It's not a matter of price — it's a matter of getting something to cover you," said Terry.

Reach Holly Fletcher at 615-259-8287 or on Twitter @hollyfletcher.

Source: https://www.tennessean.com/story/money/industries/health-care/2016/09/29/consumers-rattled-by-insurance-options-without-bcbst/91187772/

0 Response to "Blue Cross Blue Shield of Tennesse Vs United Healthcare"

Post a Comment